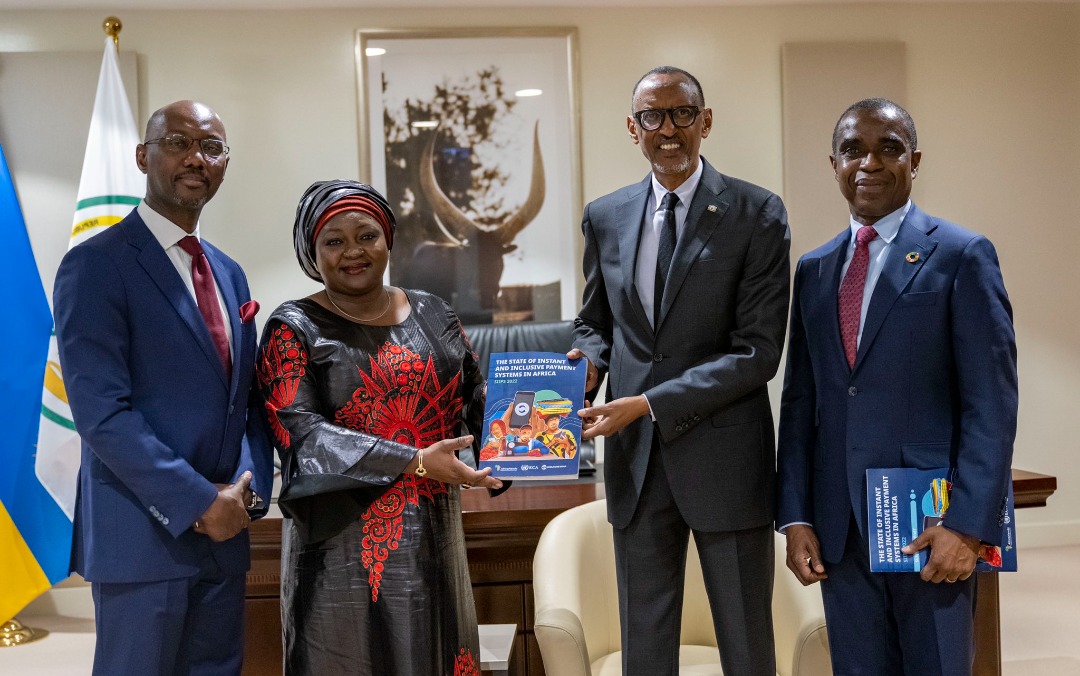

President Kagame received a copy of the SIIPS Africa Report from the AfricaNenda Team

The first State of Instant and Inclusive Payment Systems in Africa report (SIIPS – Africa) has been launched with a call for more inclusivity to leverage the current payment systems and infrastructure to benefit Africans and push the African Continental Free Trade Area agenda.

The report, prepared by AfricaNenda, the United Nations Economic Commission for Africa (UN ECA), and the World Bank (WB) was launched this October 25, 2022, on the sidelines of the 2022 Global System for Mobile Communications Association Mobile World Congress (GSMA- MWC) on happening in Kigali city.

Robert Ochola, CEO AfricaNenda said “IPS is critical in the successful implementation of the African Free Continental Trade Area (AfCFTA) Agreement by providing instant and inclusive payment solutions for the majority of businesses on the continent, including SMEs”

The report provides a detailed landscape of Instant Payment Systems (IPS) in Africa and highlights ways in which they can become more inclusive to leave no African behind in the digital era, highlights how they can create opportunities and advance financial inclusion, and benchmarks instant payments in Africa.

Robert Ochola, CEO AfricaNenda speaks at the report launch.

The SIIPS – Africa report 2022 shows that IPS are growing rapidly, with 29 systems have gone live on the continent in the past decade. Despite all the increasing interest in these IPS, only a few are showing signs of potential to reach a state of mature inclusivity due to regulatory challenges, lack of data transparency, and high costs for both payment system providers and end-users.

The report also underlines that IPS need to take into account the lived reality of consumers more deliberately in order to address users’ needs and enable them to access various payment services through multiple channels, and so trigger a more regular usage of digital payments.

Trends indicate that there is a rapid rise of IPS deployment in Africa- 29 mapped live instant payment systems in Africa (26 domestic IPS, 3 regional IPS) and of these, 72% of IPS support person-to-person (P2P) and person-to-business (P2B) making approximately 16 billion transactions processed in 2021 worth a total value of over $930billion (32% average annual growth in total transaction volumes since 2018; and 40% average annual increase in total value).

Though it shows that Two out of three end-users make digital transactions on a weekly basis and many efforts to achieve inclusivity the report showed that, no IPS has yet reached a mature inclusivity level.

Sabine Mensah, AfricaNenda Deputy CEO unveils the report

“Most IPS do not offer access to channels most demanded by end-users and do not yet enable cross-domain interoperability for more end-user choices. Many of them only provide limited use cases, and only a handful have integrated B2P, P2G, and G2P payments,” the report said in part.

Based on ranking, the report also showed that 13 IPS were not ranked (not fulfill basic inclusivity criteria), 11 in the basic level Minimum channel and use functionality)- including Rwanda, 5 on the progressive level, and non at the mature level (above the other levels but with Low-cost for end-users within a not-for-profit business model)

Claire Akamanzi, the CEO of Rwanda Development Board (RDB) and Board member of AfricaNenda said Africa deserves the best in many ways, and bringing instant and inclusive payment systems not only supports businesses; it brings conveniences; it brings sufficiency but also supports businesses to grow faster.

RDB CEO Clare Akamanzi.

“I think it’s really important to think about how inclusive our payment systems can bring cheaper and faster ways to cross border transactions that we are expecting from the AfCFTA. As Rwanda, we are really committed to making this all happen. we encourage disruption and continuously make the country attractive for businesses and fintech’s in particular” Akamanzi said.

Rwanda’s Minister of ICT and Innovation commended the report and AfricaNenda’s support to transforming Rwanda’s IPS, especially on cross-border trade and P2P establishment but asked the organization consider doing research on the Fintech ecosystem to deeply inform the market operations.

Alice Zanza, the World Bank Senior Payment Systems Specialist said that the bank recognizes the IPS development in Africa and is willing to provide technical assistance and policy development to make payment more inclusive.

Rwanda’s Minister of ICT and Innovation, Paul Ingabire

A panel discussion on Landscape Findings

Alice Zanza, Senior Payment Systems Specialist at the World Bank

AfricaNenda Deputy CEO, Goodluck Akinwale said the biggest challenge they faced while putting together the report was lack of or limited access data.

Dr. Mactar Seck represented UNECA

Claire Akamanzi, the CEO of RDB and Rwanda’s Minister of ICT and Innovation, Paul Ingabire (both in the middle front) officiated the launch event at GSMA MWC 2022 in Kigali.