Central Bank Governor, John Rwangombwa (middle) presenting the report to both chambers of parliament

The Governor of the National Bank of Rwanda (BNR), John Rwangombwa has revealed that Rwanda has made progress in developing a cashless economy and by next year all services will be interoperable.

Rwangombwa made the revelation this November 18, while presenting to both chambers of Parliament the Central Bank annual report of July 1, 2023 to June 30, 2024.

Following the campaign which started in 2020, before COVID-19, Rwangobwa said that the uptake of the cashless drive was driven by the pandemic and so far a lot of progress has been made especially in mobile money transactions.

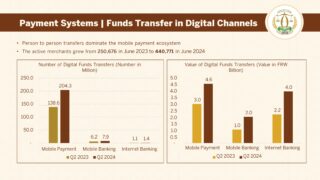

The number and value of digital funds transferred (on mobile banking, mobile money and internet banking) increased in billions between 2023 and 2024 and according to BNR, the main drivers of financial inclusion gains over this period have been U-SACCOs and, more recently, mobile financial services.

Internet banking, which is now fully operational through the Central bank which operates 24/7 to ensure all payments and cheques are matured on time, grew from 1.1million to 1.4miilion transactions and a near to double digit growth in value from Rwf2.2billion to Rwf4billion

Mobile money payments had the highest increase with the number coming from 138.6million to 204.3million while the value increased from Rwf3billion to Rwf4billion in the same periods, and active merchants doubled from 250,676 to 440, 771, according to the BNR data.

However, as of now, one can send money from one telecom service provider to another service with a relative fee charge however, the merchant codes (MTN and Airtel) operate separately requiring one to have subscribed.

“By next year we expect that almost all financial services interoperable whether you have an MTN or Airtel code or any digital channel, you will be able to make payments as all will be interconnected,” Rwangombwa said.

“The financial sector is stable for now and we are confident that despite some challenges like cyber-attacks, we are doing well in the financial sector,” the Governor informed parliament.

Central Bank presenting its annual report of July 1, 2023 to June 30, 2024 to both Chambers of Parliament on November 18, 2024

Using the Open finance, BNR said that they plan to improve use of technology and financial data. The governor revealed that the bank is working on a digital currency project which will easy financial payments.

Besides improving and offering tech driven services in Rwanda’s financial sector, Governor Rwangombwa said the same will apply inside the BNR following the approval of a digital transformation strategy (in June) that will improve all BNR internal services and processes.

“For example, applications for licenses, among other services, we want our bank to be purely digital in the next five fives so as to improve our service delivery,” Rwangombwa said.

Umurenge To District SACCO Project:

Kagano Sacco in Nyamaseke district

Rwanda has 688 financial institutions of which the majority are Microfinance and 458 savings and credit schemes (SACCOs) and Umurenge sectors savings and credit schemes (Umurenge Saccos), while commercial banks are 11 (with over 65% of the market share) on top of pension schemes and Fintechs.

As of June the last of the 416 Umurenge Saccos (Kagano Sacco) had been fully automated paving the way for the establishment of the national Cooperative Bank.

The automation phase means that the saccos can now do core banking services using technology. This involves transitioning U-SACCOs from manual to automated management information systems for improved efficiency and member service and any of the U-SACCOs is able to eliminate physical journals and offer real-time mobile notifications of transactions made on members’ account.

The Finance ministry says that the next step is a pilot project to connect Saccos on the mobile money platforms and the next focus will be on consolidating U-SACCOs into District Saccos (D-SACCOs) nationwide and deploying mobile banking systems across all branches.

Updating parliament on progress, Rwangombwa said that by December 2024 all U-Saccos in Kigali city will have been connected to the three existing D-Saccos and the lessons will be used to implement the full scale countrywide.

By the end of this financial year, all Saccos (U-Saccos) will have been interconnected to form the district saccos to improve their capacity of saccos to offer better services,” Rwangombwa said.

Financial Inclusion:

Women in cross-border trade still face major challenges.

The governor showed that there are still gaps in financial literacy and inclusion between women and men, despite the fact that overall financial inclusion clocked 96% (in 2024) and formal financial inclusion reached over 92% (from 77% in 2020) while access to credit financing standing at 24% and savings stood at 59%.

The Governor revealed that, with the ministry of finance, they are developing a financial inclusion and sector development strategy that will not only consider access but also impacting on lives of Rwandans

In 2016 financial gaps between men and women stood at 11% and this dropped to 7% in 2020 and has reached 4% as of 2024.

“We want to remove this remaining gap so that there is no gap in financial services,” Rwangombwa said.

Kagano Sacco serving clients after the finanl automation in June 2024