In 1994, Rwanda found itself at crossroads. The country’s economy lay in ruins, its coffers empty, and the devastation of the genocide against the Tutsi had left the nation in disarray. In this backdrop, no private investor would have considered Rwanda a viable place to invest.

The Rwanda Patriotic Front (RPF Inkotanyi), leading a government of national unity, had an enormous challenge: rebuilding a nation from the ashes. It was from this daunting scenario that the idea of Tri-Star Investments Limited, which would later become Crystal Ventures Limited (CVL), was born.

Tri-Star emerged from the highly organized Production Unit maintained by the RPF during the liberation struggle from 1990 to 1994. Initially funded by political contributions to the war effort from supporters, Tri-Star aimed to attract individuals with business acumen and capital, particularly from the Rwandan diaspora.

Within a few years of the RPF’s ascension to power, Tri-Star-owned companies had diversified into metals trading, road construction, housing estates, building materials, fruit processing, mobile telephony, printing, furniture imports, and security services.

Establishing Crystal Ventures Limited

Crystal Ventures Limited (CVL) was established in 1995, initially under the name Tri-Star Investments Limited. This was a critical period just after the genocide, which had decimated Rwanda’s economy and sectors like agriculture, trade, and business. With an almost non-existent private sector and manufacturing sector, Rwanda struggled even to supply basic necessities. This dire situation necessitated CVL’s investment in various business projects to help kick-start the economy.

One of the earliest CVL – owned businesses was Umutara Enterprises, created to import essential goods, including home furnishings. Despite the high risks and steep learning curves, CVL persisted, demonstrating a willingness to fund investments with high social benefits and positive economic externalities.

Using Tri-Star, the RPF has employed a straightforward yet challenging model: identify sectors where no private investor is willing to take the risk, make the initial investment, and then demonstrate the potential for substantial returns. Once Tri-Star companies start showing significant profits, private investors quickly follow suit. This strategy has proven highly effective.

Pioneering Mobile Telephony: MTN Rwanda

One of Tri-Star’s most significant early investments was in MTN Rwanda. At a time when global operators found Rwanda’s potential subscriber base uninteresting, and the government was financially incapacitated, Tri-Star funded the establishment of the MTN cellphone network. This venture was a spectacular success, leading MTN to expand its equity share.

Tri-Star initially held approximately 65% of the equity, with MTN South Africa holding 26%, and the Rwandan government contributing the balance. Over the years, Tri-Star gradually reduced its share, realizing substantial returns on its investment.

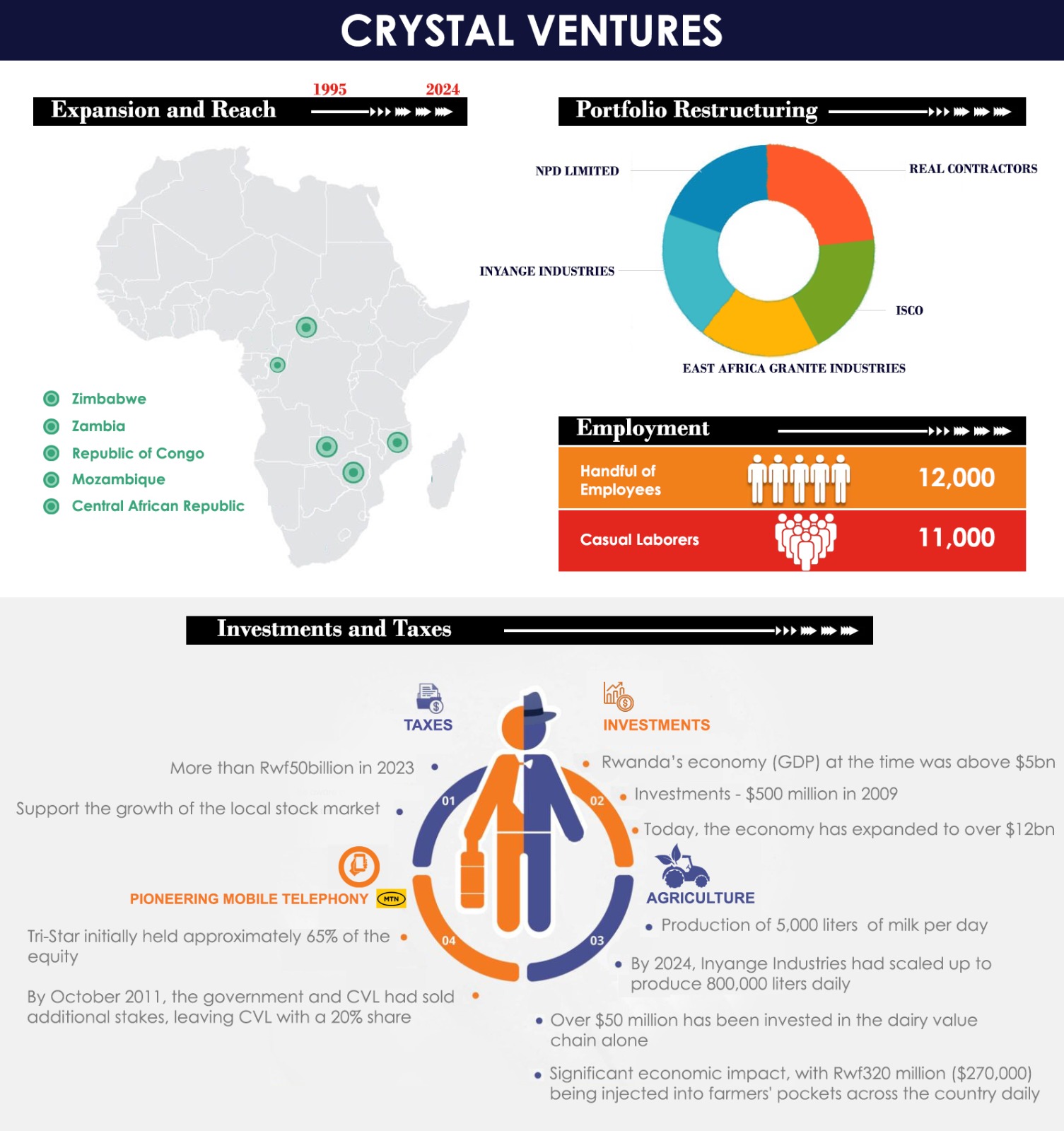

By October 2011, the government and CVL had sold additional stakes, leaving CVL with a 20% share. Tri-Star’s investment not only introduced mobile telephony to Rwanda but also ensured that the network had substantial domestic ownership. This venture had spill-over benefits for the wider information and communication technology field, with new IT firms being established by Rwandan entrepreneurs.

Diversification and Expansion

CVL’s investment strategy wasn’t confined to telecommunications. Recognizing the need for high-standard accommodation in a peaceful Rwanda, CVL invested in hotels, bringing the first 5-star hotel brands to Kigali, such as Intercontinental Hotels, now Serena Hotels.

In the construction sector, CVL leveraged its financial capacity to enable local players to compete with international suppliers. This was particularly critical in building and road construction, where international firms often had significant financial advantages.

Building the Agriculture Sector

One of CVL’s core businesses, Inyange Industries, started with a modest production of 5000 liters of milk per day to meet local demand. By 2023, Inyange Industries had scaled up to produce 20,000 liters daily, with a new plant in Nyagatare expected to produce 800,000 liters per day.

Jack Kayonga, CEO of CVL, highlighted the significant economic impact, with Rwf320 million ($270,000) being injected into farmers’ pockets across the country daily. Over $50 million has been invested in the dairy value chain alone, underscoring CVL’s commitment to supporting local farmers and ensuring market stability for their products.

“So we expect it to be the largest industry in Rwanda by the end of this year,” Kayonga said while appearing on The New Times Publication podcast interview, “The Long Form Rwanda”, in June.

Telling Their Own Narrative

Historically, CVL has been reticent about publicizing its achievements, a strategy that has sometimes led to misrepresentations. CEO Jack Kayonga emphasized the need for CVL to tell its own story proactively.

“So as a strategy, we are looking at being more proactive, telling our own story because we do actually have very many good stories to talk about,” Kayonga said.

One significant step in this direction is the planned Initial Public Offering (IPO) by 2025. This move aims to open CVL’s shares to Rwandans and the global market, thereby enhancing transparency and reducing perceptions of political affiliation.

“When you go to the stock exchange, free some of the shares into the public, then you cease to be a politically affiliated company, you become a public company. So, from a reputation point of view it is also very good,” Kayonga said.

As of 2009, CVL’s investments were valued at over $500 million, a figure that has grown significantly. There are no current portfolio figures, but to give you a sense, look at it this way. Rwanda’s economy (GDP) at the time was still at slightly above $5bn, a meager size. Today, the economy has expanded to over $12bn.

The company is currently undergoing a portfolio restructuring to focus on strategic operations in construction, security, and food and beverages before listing on the Rwanda Stock Exchange (RSE). Kayonga noted that this listing would enable CVL to attract more capital from both local and international investors, supporting further growth and reputation management.

By listing, this will enable CVL as a company to get more money from the local public and the ones abroad (diaspora) to either divest or reinvest into business areas of focus, to manage its reputation of being known as politically affiliated.

Adding that this will also contribute to the growth of the local stock market and most importantly for Rwandans to own one of the biggest companies in the country.

Future Prospects and Regional Expansion

CVL has undergone significant transformation in corporate governance, operations, finance, human capital management, communications, and IT systems. This transformation positions the company for sustainable growth and expansion. Building on its success in Rwanda, CVL has extended its operations to countries like Zimbabwe, Zambia, Republic of Congo-Brazzaville, Mozambique, and the Central African Republic. These expansions leverage bilateral relations to foster business connections.

Looking ahead, CEO Kayonga envisions CVL leveraging its investment portfolio to tap into the growth potential across the African continent. The goal is to create firms that are attractive to international direct investors, not just dominant players in domestic markets. The company’s board, with banking or financial management backgrounds, is committed to maintaining high standards of efficiency and management reporting.

Financial Contributions and Social Impact

As Rwanda’s economy recovered from its post-genocide depression, CVL’s firms became profitable, with benefits flowing back to the RPF in the form of dividends. According to a July 2012 study published by Oxford University’s “African Affairs” journal, there is no evidence of direct profit-taking by individual politicians or military leaders, underscoring the ethical management of profits.

In 2023, CVL companies paid over Rwf50 billion ($45m) in taxes, illustrating their significant contribution to the national economy. By listing on the stock exchange and opening up to public investment, CVL aims to enhance its reputation, support the growth of the local stock market, and ensure that Rwandans have a stake in one of the country’s largest companies.

From its inception in 1994 as Tri-Star Investments Limited to its evolution into Crystal Ventures Limited, CVL has played a pivotal role in Rwanda’s economic recovery and growth. Through strategic investments in diverse sectors, from telecommunications to agriculture, CVL has not only contributed to Rwanda’s economic development but has also created a model of socially responsible and forward-thinking investment. As it looks to the future, CVL is poised to continue its legacy of innovation, growth, and positive impact on both the national and regional stages.