Senior officials, including the Minister of Finance and Economic Planning, Dr. Uzziel Ndagijiimana, pose for a group photo at the kick off of the mock assessment.

Rwanda has committed to ensure that the country meets all required standards set by the Global Forum on tax compliance and transparency, in a move that is aimed at reiterating the country’s ambition and readiness to ease doing business and attract investors.

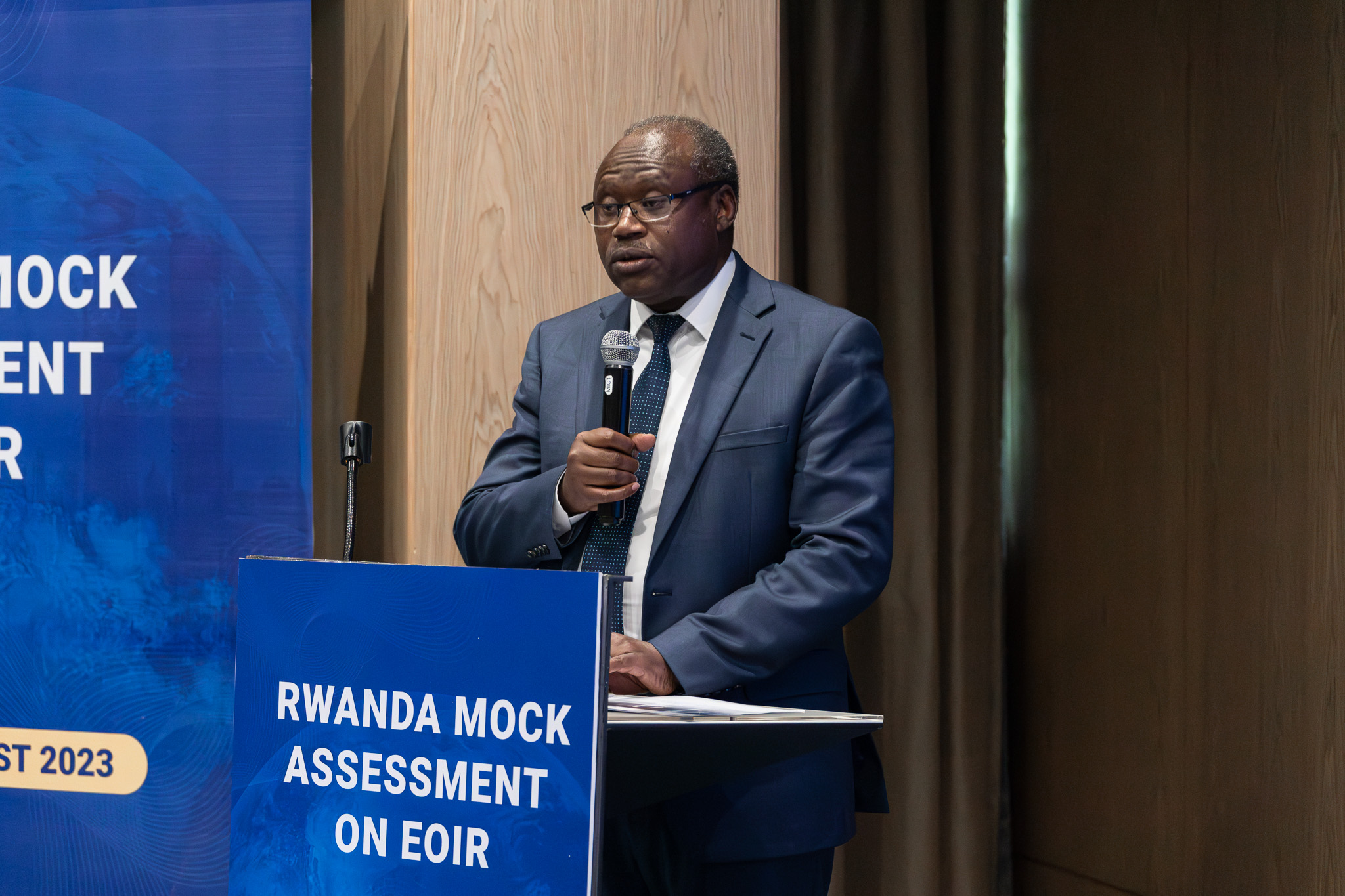

A mock exercise aimed at assessing Rwanda’s implementation of global forum standard on exchange of information for tax purposes kicked off on Monday, officially opened by the Minister of Finance and Economic Cooperation, Dr. Uzziel Ndagijimana, who emphasized Rwanda’s readiness to uphold international standards on tax transparency.

Officials from the Global Forum secretariat are in Kigali to conduct an on-site mission which kicked off on Monday, July 31, running up until August 4, where they will assess the level of readiness of the legal and regulatory framework for implementing the Exchange of information on request standard (EOIR).

The move is in preparation for the Exchange of Information On Request (EOIR) Peer Review of Rwanda that is scheduled to take place between 1st October and 31st December 2023, where officials will determine if the country is complying with the set standards.

Dr. Ndagijimana said that Rwanda is working around the clock to fulfil the standards required by the global forum.

Rwanda joined the Global Forum on Transparency and Exchange of Information for Tax Purposes (Global Forum) in December 2017 and committed to implementing the EOIR standards as well as the Automatic Exchange of Information on financial accounts (AEOI standard).

This Mock assessment served as an opportunity to take stock of progress made towards improving Rwanda’s tax transparency standards, especially after the recent amendments of several laws to reflect the Global Forum international transparency requirements.

According to officials, tax compliance is paramount to the work the Kigali International Financial Centre is doing in terms of becoming a fully compliant jurisdiction that will attract international investment and cross- border transactions in Africa.

Kigali International Financial Centre works closely with key stakeholders to establish a legal and regulatory framework for Rwanda to comply with Global Forum International transparency requirements.

Speaking at the opening of the mock assessment exercise, Dr. Ndagijimana, Minister of Finance and Economic Planning, said that as Rwanda aims to become an Upper-Middle income country by 2035 and a High-Income status by 2050, the government is positioning the KIFC to be the main driver of investment and doing business.

“To drive this future growth KIFC is one of the strategic pathways that we have identified to foster increased financial inflows into the country, through promoting cross-border investments and increasing the financial services’ value addition to the Rwandan economy,”

“To drive this future growth KIFC is one of the strategic pathways that we have identified to foster increased financial inflows into the country, through promoting cross-border investments and increasing the financial services’ value addition to the Rwandan economy,”

“Within this context, tax compliance is increasingly taking up a vital position in driving economic growth and stability,” Minister Ndagijimana said.

“We believe that transparency and the exchange of information for tax purposes are crucial for generating additional tax revenues, identifying cases of tax evasion, and boosting the country’s tax compliance standards,” he added.

Minister Ndagijimana said that the EOIR and AEOI standards are priorities for Rwanda, which is why the country chose to join the Global Forum in 2017, a global framework that enables information sharing among tax authorities.

He said that given the rise of illicit financial flows over the last few years, significant efforts need to be made to effectively improve the continuous global fight against tax evasion and tax avoidance.

Representatives of financial institutions were present.

According to the United Nations Conference on Trade and Development (UNCTAD) Economic Development in Africa Report released in 2020, Africa loses around $88.6 billion in illicit financial flows, which accounts for 3.7% of the continent’s gross domestic product (GDP) annually.

Minister Ndagijimana said that tax transparency and the exchange of information are fundamental steps in tackling issues relating to illicit financial flows and increasing domestic resource mobilization, which he said is central to achieving sustainable development.

“Rwanda has pledged to adopt the international AEOI standard for exchanging financial account information for tax purposes by 2024. This standard, already in use in over 100 jurisdictions worldwide, will be a game changer for Rwanda by helping to identify tax evasion and improve tax transparency,”

“In addition to our commitment to implement AEOI by 2024, Rwanda has also been actively participating in other initiatives aimed at promoting transparency and the exchange of information for tax purposes,” he pointed out.

He said Rwanda has been working closely with the Global Forum on capacity building and technical assistance activities to ensure that tax authorities have the necessary tools and knowledge to effectively implement these standards.

He said Rwanda has been working closely with the Global Forum on capacity building and technical assistance activities to ensure that tax authorities have the necessary tools and knowledge to effectively implement these standards.

“This mock assessment comes at a crucial moment, providing Rwanda with an opportunity to demonstrate the progress made towards improving the tax transparency standards following the country’s recent legal reforms intended to broaden the tax base and improve tax compliance and transparency to reflect the Global Forum International transparency requirements,” he said.

According to the tax transparency in Africa 2023 report, exchange of information is now well established as an effective tool to tackle tax evasion and other illicit financial flows and can play a critical role in enhancing African countries’ domestic resource mobilisation efforts to raise much needed revenues.”

Pascal Bizimana Ruganintwali, Commissioner General Rwanda Revenue Authority (RRA) reiterated the need to tackle illicit financial flows which have direct implications not just on revenue collection but also the economy at large.

Pascal Bizimana Ruganintwali, RRA Commissioner General.

He said through such standard information sharing exchanges, countries can nip in the bud the challenge of illicit financial flows and at the same time increase revenue correction.

He thanked the Global Forum, which is under OECD, for the support and orientation it has given Rwanda so far, pointing out that the country has already made progress in terms of putting in place the necessary legal instruments.

“Tax transparency and exchange of information is helping African countries reduce illicit financial flows so as to increase their domestic resource mobilization,”

“Rwanda in the same respect, is taking bold actions to protect its tax base and some of the measures include; ensuring enough accessibility to tax information on cross-border transactions, strengthening its internal capacities for raising domestic taxes and significantly reducing tax evasion or avoidance arising from base erosion and profit shifting schemes,” he said adding that all efforts are aimed at boosting Rwanda’s domestic resource mobilisation avenues.

Nelly Mukazayire, Deputy CEO, Rwanda Development Board (RDB) said that Rwanda is doing all it can to align all the legal and regulatory frames in line with the country’s vision to ease doing business and investment.

She said that Rwanda conforming with the Global Forum standards of compliance and transparency would be a huge step for the country towards improving further doing business and opening up Rwanda to the world.

She said that Rwanda conforming with the Global Forum standards of compliance and transparency would be a huge step for the country towards improving further doing business and opening up Rwanda to the world.

Among other things, she said Rwanda has established the beneficial owner’s registrar, which is a requirement by the law establishing companies and other laws such as partnership and trust laws.

The central database with this information is maintained by RDB and according to Mukazayire, the e-register will also be key in providing the information required on the tax base.

“The e-register serves as a robust tool to fulfil this duty efficiently and we are confident that it will play a pivotal role in maintaining accurate and updated data or records of beneficial ownership information,” Mukazayire said.

She pointed out that over the few months, RDB has been able to work with partner institutions such as Rwanda Information Society Authority (RISA) and others, to fine tune the system, ensuring it meets the highest standards of userbility, security and efficiency.

RDB Deputy CEO, Mukazayire, follows the presentations.

“I am pleased to report that as of 28th July, we had a total of 2, 917 companies that have already submitted their beneficial owners’ details through the e-registrar while 236 companies and started the reporting but were yet to complete and submit,”

“This is a remarkable achievement and demonstrates the commitment of the Rwanda business community to adhere to the principles of transparency and corporate responsibility,” Mukazayire said.

The RDB Deputy CEO said that the beneficial owner’s registrar was developed as a standalone system, separate from the business registration system and partially because access to beneficial ownership Information is limited while the basic company information is accessible to the public.

She added however that the beneficial owners e-register has been meticulously integrated and synchronized with the business registration system, so that they can speak to each other and allow them to fetch some information directly from when the business is registered to the point when ownership is being reported.

“This integration ensures that the personal identification data of beneficial owners is accurate and up to date, providing an additional layer of reliability of the information captured in the e-registrar,”

“By leveraging the synergy between RDB, RRA and NIDA, we strengthen the fight against financial crimes and enhance transparency of companies registered in Rwanda and the integrity of our business environment,” Mukazayire said.

Since joining the Global Forum, Rwanda has been able to put in place the building blocks for the two standards upon which a new member is assessed, including the legal and regulatory framework, based on an agreed roadmap.

The KIFC is a financial centre facilitating international investment and cross-border transactions in Africa. It positions Rwanda as a preferred financial jurisdiction for investments in Africa by providing an attractive destination for investors with a legal and regulatory framework fully compliant with international best practices.

The Global Forum on Transparency and Exchange of Information for Tax Purposes is the leading international body working on the implementation of global transparency and exchange of information standards around the world.

Since the G20 declared the end of banking secrecy in 2009, the international community has achieved great success in the fight against offshore tax evasion. The body has 168 members.