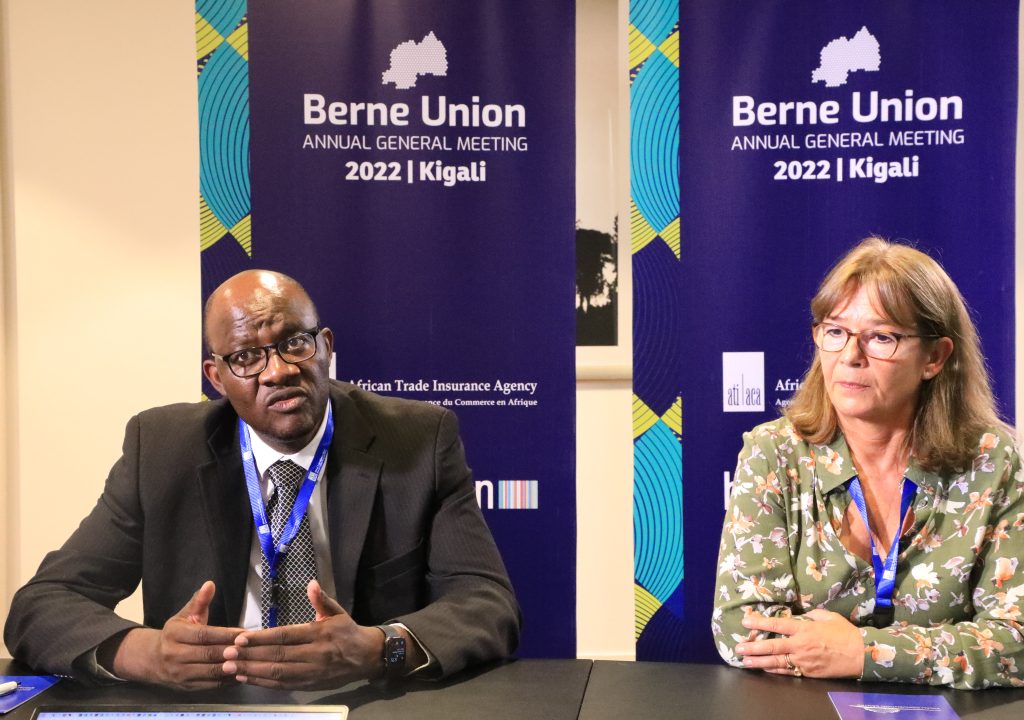

AIT’s Manuel Moses and Berne Union’s newly elected president Maëlia Dufour speak to KT Press.

With a population of 1.3 billion people and a combined GDP of over $3.5 trillion, Africa has the potential to become a global trade powerhouse if all the barriers that affect intra-Africa and international trade are removed.

Some of the key impediments to trade on the African continent include access to finance, limited investment in infrastructure and high-risk markets, which among other things makes it difficult for small and medium enterprises to access export credit facilities.

However, with the Africa Free Continental Trade Area (AfCFTA) changing prospects on the continent by promising to usher in a new era of trade, coupled with a positive outlook as countries recover from the impact of Covid-19 and the Russia-Ukraine conflict, the future has never looked bright.

In an exclusive interview with KT Press at the ongoing Berne Union 2022 Annual General Meeting, bringing together over 77 financial institutions from across the globe, Maëlia Dufour, the newly elected President of the Berne Union, and Manuel Moses, the Chief Executive Officer of the African Trade Insurance (ATI) shed light on what the two organisations are doing to unlock Africa’s trade potential.

The Berne Union is the international association for the export credit and investment insurance industry while the ATI is a pan-African institution that provides political risk insurance to companies, investors, and lenders interested in doing business in Africa.

As a member of the Berne Union, ATI hosted the 2022 Annual General Meeting in Rwanda, one of its founding members, and was officially opened on Tuesday by the Minister of Finance and Economic Planning, Dr. Uzziel Ndagijimana. The pan-African multilateral is owned by several African governments with its head office in Nairobi, Kenya.

Minister Ndagijimana speaks at the opening of the Berne Union 2022 Annual General Meeting. Photos/Eric Ruzindana.

Manuel Moses, the ATI CEO, said that Rwanda was chosen to be the host nation so that people can come from all over the world to see ‘first-hand’ and experience what the continent has to offer while at the same time exploring business opportunities.

“The choice of Rwanda was strategic in the sense that it is at the centre of the continent and it is one of the fastest growing economies in Africa. We wanted to show the world that this is how much progress we have made on the continent and Rwanda is a true representative of what we aspire Africa to be,” Moses said.

Beyond that, he said hosting the meeting in Rwanda was also partly to change the perception of what Africa is, perhaps for investors and financial institutions, some of which still view the continent as a costly and risky place to do business.

Indeed, according to Moses, delegates at the AGM will leave with a different perception of Africa, having seen what countries like Rwanda are doing to promote trade, investment, tourism and other sectors.

To add to that, Dufour, who was unanimously elected to take over the reins at the Berne Union for the next two years, said that the meeting was not only timely but it also came at the time when the spotlight is on Africa and Europe.

Dufour, the Director of International Relations, Business Development, Rating, Environment and Climate at BPI France, is deputised by Benjamin Mugisha, the Chief Underwriting Officer at ATI are confident that their leadership, representing Europe and Africa means that the two continents can work together to advance the trade agenda.

“I believe that we will do a great job together,” Dufour said following the election, adding that there is a lot the Berne Union can do with ATI to boost export credit insurance on the continent, which in turn will boost trade.

Dufour outlined her priorities over the next two years.

During the AGM, one of the key challenges highlighted included financing gaps and risk related to export credit facilities, most of which are linked to perception but Dufour said that is all changing with the appetite to invest, now shifting to Africa. For example, Bpifrance, a French public investment bank has in recent years increased its investment portfolio in African countries including Senegal, Cote d’Ivoire and Ghana, among other countries.

“BPIFrance is keen to do more business in Africa. We have $13 billion allocated to the continent, which is 13% of our portfolio,” she said. Dufour added that the French bank has interests in infrastructure, water resources, clean energy and transport, among other sectors, all of which goes to show how Africa is a hotspot for investment at the moment.

The challenge however remains that most small and medium enterprises which form the backbone of most African economies don’t have access to facilities offered by bigger banks like Bpifrance and ATI acknowledges that.

According to Moses, one of the key areas of focus during the AGM was the challenges SMEs face including constraints relating to access to finance and markets and how these gaps can be filled through the Berne Union and its members.

“This is very important because we believe that SMEs are the biggest employers in our countries. If we can unlock financing for SMEs, we can create jobs for millions of people and subsequently end the poverty cycle.”

“You don’t have to be a big company to employ people. We are talking about small companies that employ 10 to 15 people. If you add them up, the numbers are just quite big,” Moses says, making a case for small and medium companies.

The ATI CEO said that these companies eventually grow into big companies and that is where the future of the African continent is.

A myriad of opportunities

Moses pointed out that the hiccups in the supply chain presented by the Covid-19 pandemic and the Russia-Ukraine conflict revealed gaps but also presented an opportunity for export credit insurers to chip in and unblock.

More than ever, Moses said that access to export credit and insurance serve a key role in enabling trade, where players like ATI come in to fill the gap by providing the resources needed to facilitate trade.

The challenge remains on how small and medium companies can access these facilities through banks due to bureaucracy and collateral requirements by commercial banks. Similarly, cross border trade barriers remain a major impediment. However, thanks to the AfCFTA, all this is changing and Moses is convinced that ATI’s trade credit insurance will facilitate in unlocking the full potential of intra Africa trade.

Being a member of the Berne Union means that ATI has the capacity to mobilise resources from fellow members which can then be channelled to banks to be accessed by the private sector.

For that to happen, governments must play their part by removing barriers that still hamper cross-border trade and also ensure the adoption of the much-needed technology and infrastructure to boost intra-Africa trade.

“Our intention is to promote intra-African trade. Looking at the statistics, intra Africa trade remains the lowest as compared to trade between countries in other continents.”

“For example, intra-trade between Europe, South America or Asia continents, ranges between 60% to 70% but when it comes to Africa, we are still below 10%,” he says, adding that there is a lot of trade potential to unleash.

“When we talk about AfCFTA, we are talking about a trade area of 1.3 billion people and a combined GDP of over $3.5 trillion. Imagine if we could just trade amongst ourselves?” Moses says, adding that this is enough to convince those with the resources to invest in Africa.

At the global level, Dufour says that the pandemic and the Russia-Ukraine conflict did not only disrupt trade but they also increased the risk related to export credit and insurance.

Manuel Moses says the AfCFTA presents so many opportunities.

She however adds that the demand for such facilities remains very high as indicated by the Berne Union report of the first half of 2022, where members of the union provided new commitments totalling to $44 billion in support of trade and cross-border investment in Sub Saharan African countries.

Dufour said that regardless of the risk and banks remaining hesitant, the demand for export credit and insurance facilities remains and part of what the Berne Union and ATI does is to create confidence and change the perception that Africa is a risky place to do business.

Berne Union and ATI are prioritising working with governments to address the impediments that still hamper cross-border trade, including putting in place the infrastructure and technology needed to drive it.

According to Moses, ATI will also focus on working with local banks and financial institutions to put in place facilities targeting SMEs so that they can easily access funds to export their goods, once these barriers are removed.

On her part, over the next two years as President of Berne Union, Dufour intends to run a campaign built on three pillars including transparency, transfer of knowledge between member associations but most importantly, trade policies that factor in climate.

“This is really a big issue. We want to be transparent among our members on the financial incentives that come with sustainable projects, and my first priority during my tenure is to see how we can decarbonize our portfolio and how to commit ourselves in order to reach a net zero target, while my second priority is zero market failure. That is to say that we don’t want to hear our customers saying that they cannot access financing’.”

She also pointed out that during her tenure she will focus on promoting collaborations and knowledge sharing between countries and continents to holistically tackle challenges that still affect trade and investments.