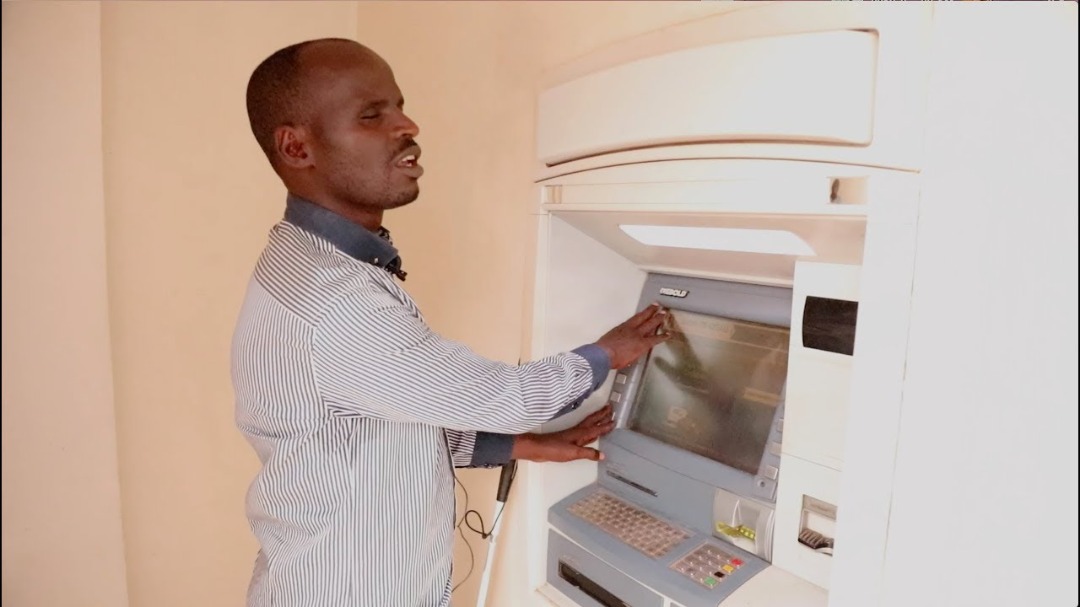

Vision impaired bank client withdraw Money at an ATM machine in Kigali. Financial inclusion has increased to 93% from 48% in 2008

The Ministry of Finance and Economic Planning has launched the 2020 FinScope Survey Report, a yardstick that measures how Rwandans are financially included and progress made towards narrowing gaps.

The main objective of the FinScope Rwanda 2020 Survey was to indicate the levels of financial inclusion; define the landscape of access; identify the drivers of, and barriers to financial access; assess trends or changes over time and provide information on new opportunities for increased financial inclusion.

According to the FinScope 2020 survey, 93% of Rwandan adults are financially included in terms of accessing and using both formal and informal financial products.

This is in comparison to 89% in 2016, 72% in 2012 and 48% in 2008.

Levels of financial inclusion vary from 99% in the Gasabo district of Kigali city to about 83% in Rusizi district, Western Province.

The survey indicates a narrowing gender gap in financial inclusion with only 8% of women excluded compared to 7% of male counterparts.

The report underscores that youth within the age range of 16 – 24 years, are the most financially excluded at 18%, significantly higher compared to the national average of 7% exclusion.

About 77% of the Rwandan population access and use formal financial products, including those that are provided by the banking sector and other from formal but non-bank financial institutions such as insurance firms, mobile network operators, Microfinance institutions/SACCOs, to mention but a few.

About 36% (from 26% in 2016, 23% in 2012 and 14% in 2008) of adults in Rwanda are banked.

The proportion of adults that are banked range from 80% in Gasabo district-Kigali to only 8% in Ngororero district- Western Province.

The banked population growth has increased by 1.1 million since 2016. About 25% of banked adults use digital financial tools up from 6% in 2016.

Moreover, about 75% of adults in Rwanda use other formal (non-bank) financial products/services. These financial services increase overall levels of formal inclusion.

The informal sector continues to play a significant role in financial inclusion and increasing product portfolio choices with about 78% of adults in Rwanda using informal financial services mainly through saving groups (ibimina).

“Financial inclusion is one of the core drivers of an inclusive economy and Government has invested significantly in removing systemic barriers to the uptake of financial services,” said Dr. Uzziel Ndagijimana, the Minister of Finance and Economic Planning.

“The FinScope survey shows that there has been tremendous improvement in financial inclusion. The work is not over yet. The objective is to achieve 100% financial inclusion by 2024 so I encourage everyone involved to keep the momentum.”

The FinScope Rwanda survey is a nationally representative demand-side survey conducted every 4 years to address the need for credible financial sector information.

It offers insights to guide policymakers, regulators and financial service providers in terms of how to address or respond to existing challenges, monitoring and reviewing the financial inclusion target.

The first FinScope Rwanda Survey was conducted in 2008, driven by a lack of credible information to guide policy interventions and financial service providers in their efforts to expand the reach and depth of the Rwanda financial system.

The survey was conducted in partnership with Access to Finance Rwanda (AFR).

AFR, on behalf of the Government commissioned follow-up surveys in 2012, 2016, and 2020. The later illustrates how many adult Rwandans are financially included, specifically aligning the levels of inclusion to the revised National Financial Inclusion Strategy (NFIS) and to report any changes since the last FinScope survey.

AFR is a Rwandan non- profit organization, with a strategic focus of stimulating financial sector development by collaborating with financial institutions and other stakeholders to increase access to and use of financial services.